Capital gains calculator for home sale transactions

Enter an Address Start Analyzing. Ad Sell Your Home with Simplicity Speed and Certainty.

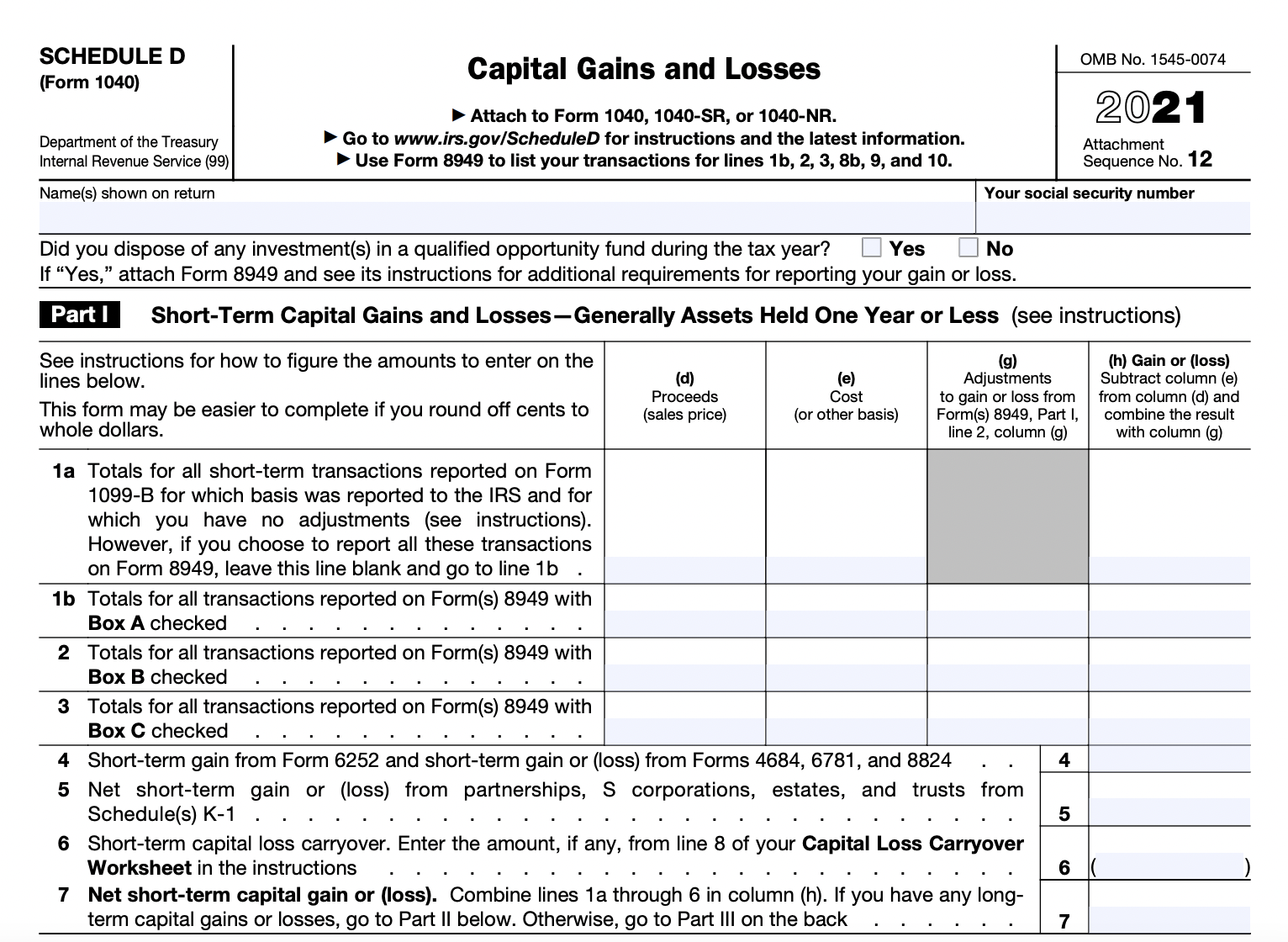

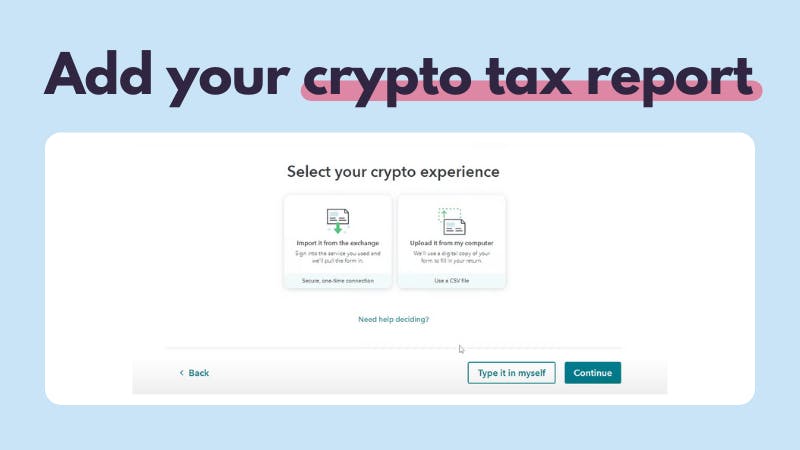

How To Report Crypto On Tax Forms 8949 And 1040 Tokentax

Please enter your figures in the fields provided enter your.

. Use our capital gains calculator to figure out what your gain might be. The total tax on the gain. This real estate capital gains calculator should be used to estimate the capital gains tax you may pay if you sell your home or land or any other capital asset.

We have compiled an Excel based Capital gains calculator for Property based on new 2001 series CII Cost Inflation Index. Capital Gains Calculator These calculations show the approximate capital gain taxes deferred by performing an IRC Section 1031. Ad Your Investment Property Search Begins and Ends Here.

These gains are taxed more favorably at 0 15 or 20 percent depending on the amount of gain. Property Basis Sale of Home etc Stocks Options Splits Traders Mutual Funds. Capital gains and losses are taxed differently from income like wages interest rents or royalties which are taxed at your federal income tax rate up to 37 for 2022.

Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or. Ad See why Urban Catalyst is a trusted leader in opportunity zone fund investing. As a quick way to find out what youre in for use an online capital gains.

Home Sale Proceeds Calculator Our home sale calculator estimates how much money you will make selling your home. Capital Gains Selling Price Purchase Price 12000 - 10000 2000 Capital gains tax is only paid on realized profits and not on unrealized profits. Invest in Silicon Valley Real Estate.

The first step in how to calculate long-term capital gains tax is generally to find the difference between what you paid for your asset or property and how much you sold it for adjusting for. A capital gain occurs when you make a profit on the sale of your home. Capital Gains Tax Calculation Proceeds of Disposition - Adjusted Cost Base Total Capital Gain Total Capital Gain 50 Inclusion Rate Taxable Capital Gain Taxable Capital.

Ad See why Urban Catalyst is a trusted leader in opportunity zone fund investing. Capital gains taxes on. Learn More for Free.

Now plug that figure into the following formula to calculate your capital gains or losses. It calculates both Long Term and Short Term capital. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

Get Fast Competitive Offers Directly from Our Pre-Approved Buyers. Sale price commissions legal fees and marketing fees paid during sale adjusted. Profits become realized when they.

2021 capital gains tax calculator. ESTIMATED NET PROCEEDS 269830 Desired selling price 302000. Frequently Asked Question Subcategories for Capital Gains Losses and Sale of Home.

2022 capital gains tax rates. Calculate Airbnb Income Potential. Invest in Silicon Valley Real Estate.

Indexation Benefit Meaning And Calculation For Real Estate Property

The Costs And Taxes Of Selling Property In Mexico

How Real Estate Commission Splits Work Negotiation Tactics Free Calculator

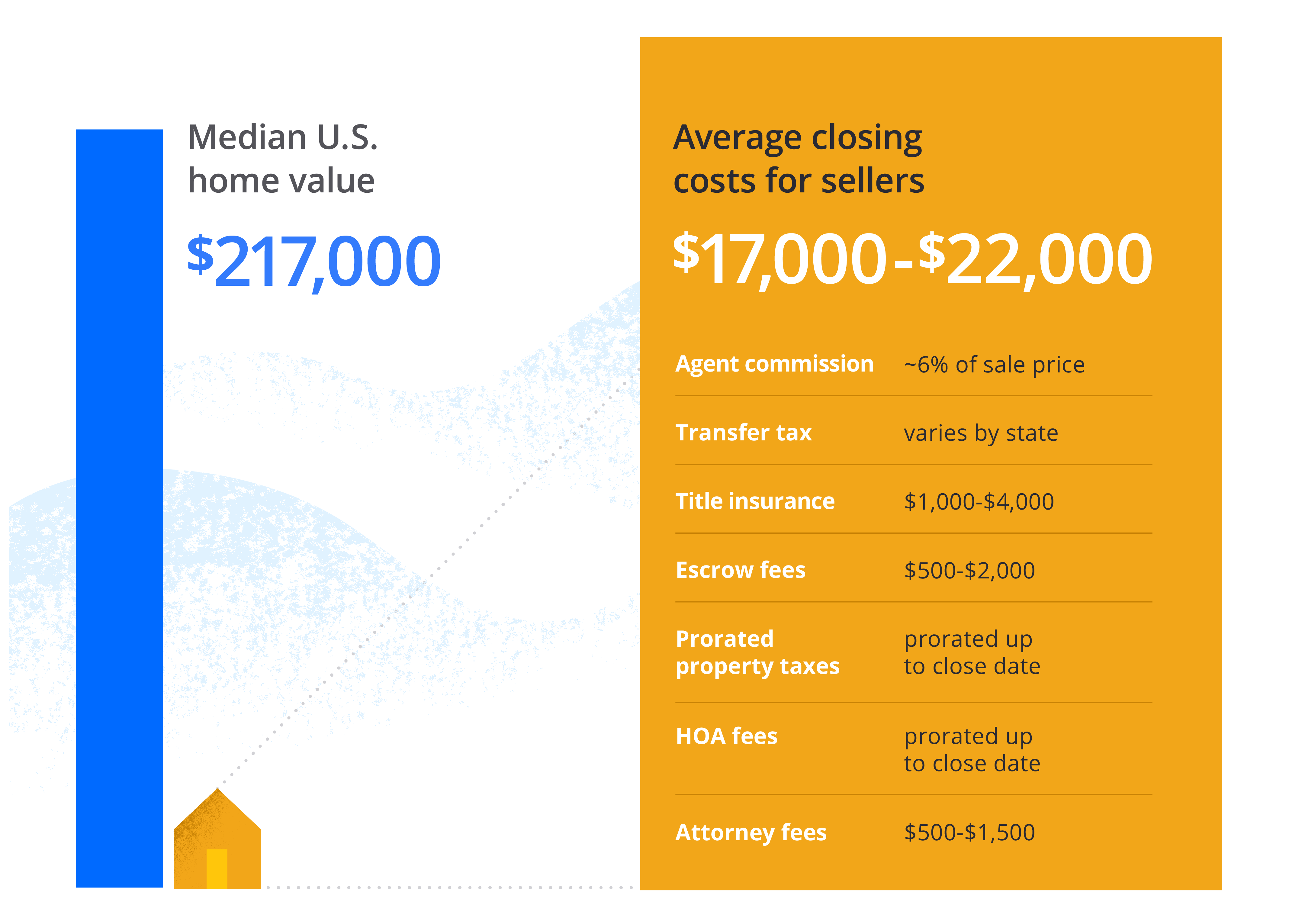

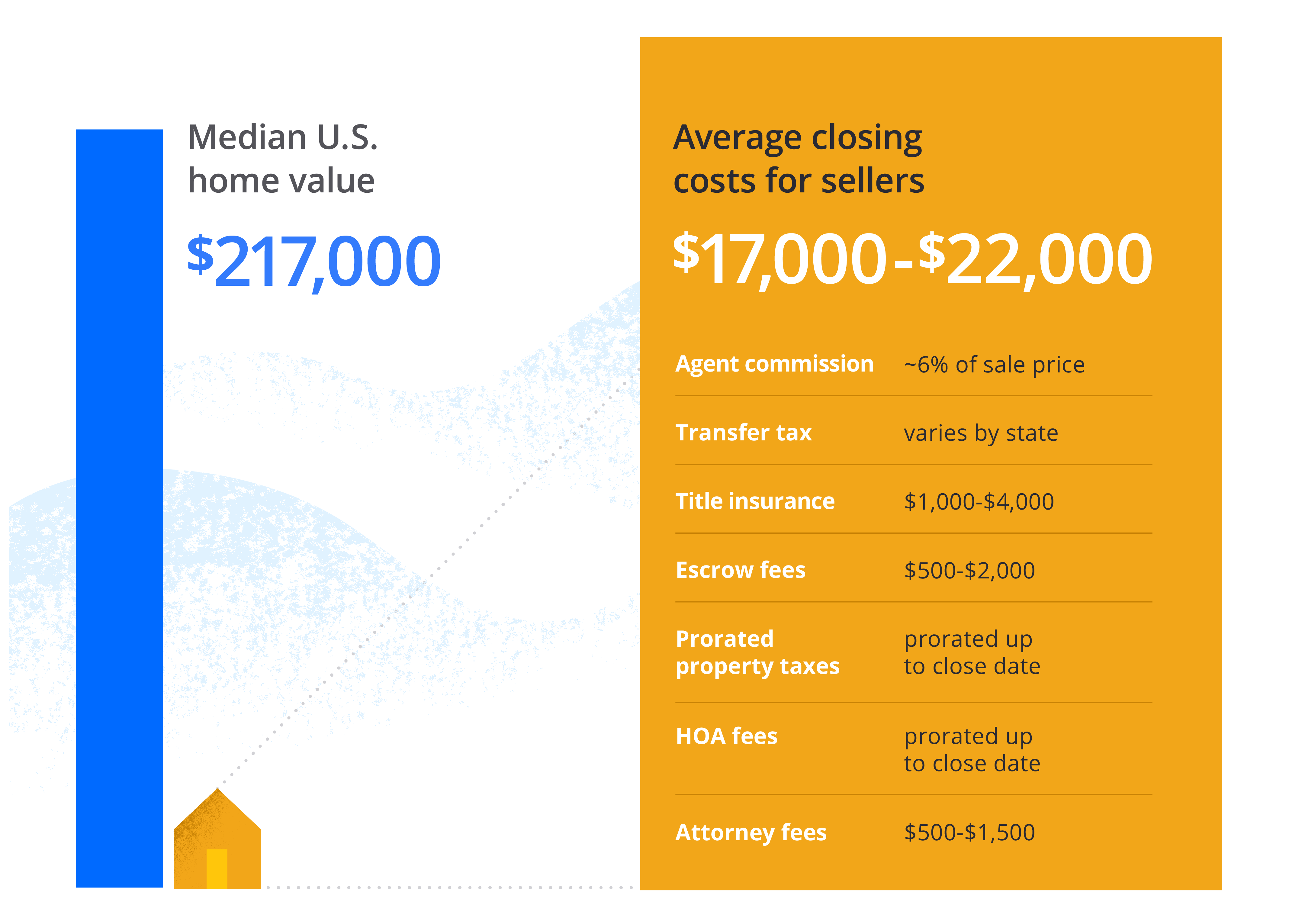

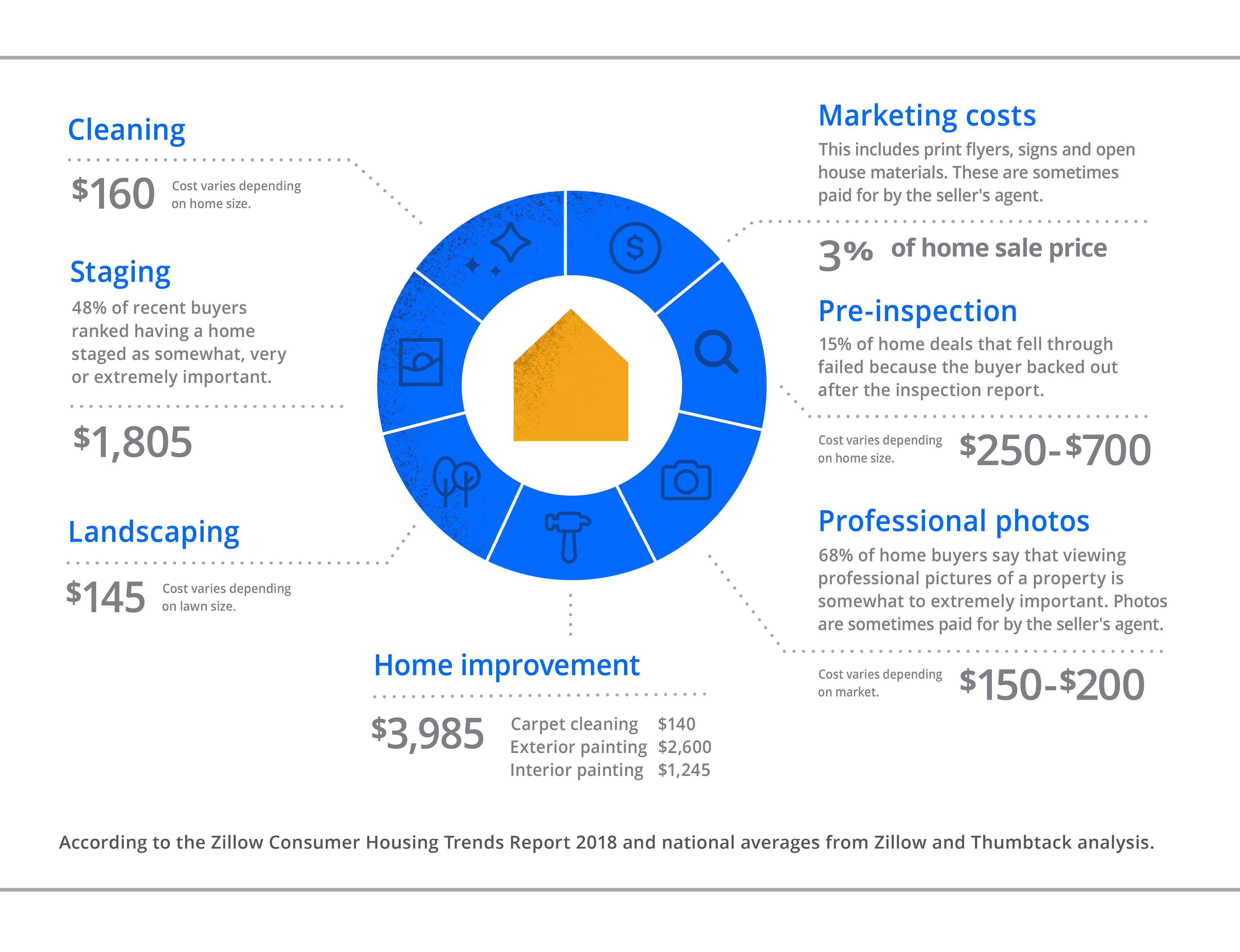

How Much Does It Cost To Sell A House Zillow

Estimated Tax Penalties For Home Resales

How To Calculate Capital Gains Tax H R Block

Return On Equity Roe Calculator For Real Estate Investing Denver Investment Real Estate

How Much Does It Cost To Sell A House Zillow

How To Report Crypto On Tax Forms 8949 And 1040 Tokentax

Passive Income Tax Rate What Investors Should Know 2022

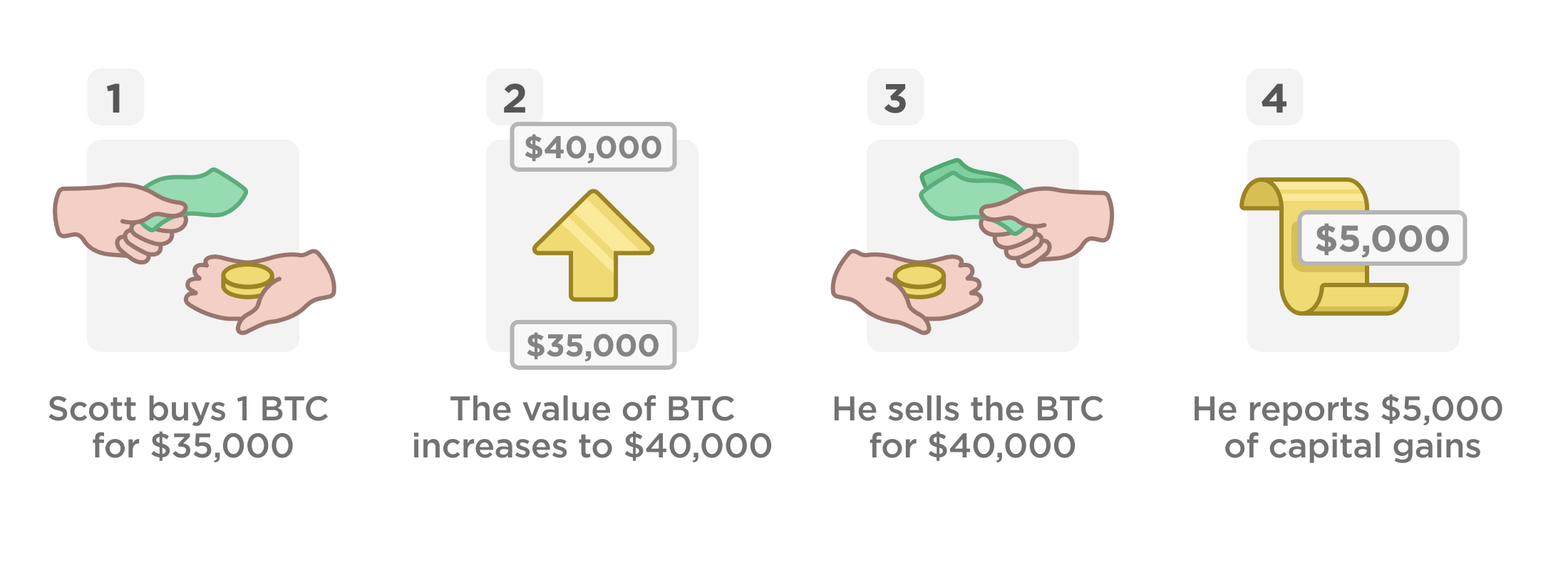

Exploring Bitcoin Income Losses And Investing H R Block

Capital Gains Tax Explained What Is It How Much It Is The Turbotax Blog

Form 8621 Calculator Excel Import Guide Expat Tax Tools

How To Calculate Capital Gains Tax H R Block

How Much Does It Cost To Sell A House Zillow

How To Do Your Crypto Tax With Koinly Turbotax 2022

How Much Does It Cost To Sell A House Zillow